Step 5: Price and availability

Rentals United automatically detects what may be your preferred pricing model. This happens upon the first-time connection to Airbnb for each of your properties, as well as later when the following processes take place:

-

when adding a new listing to Airbnb

-

when mapping Rentals United property to the Airbnb listing

Also, note that the pricing model setting in Airbnb is selected per property. It means that some of your properties within one account may operate on the LOS pricing while others - on the Daily price model.

The pricing model detection and setting is based on the following rules:

-

LOS pricing: If the property has at least one day in the future with pricing that requires the LOS pricing model to be set in the channel, i.e. LOS pricing, FSP pricing, Occupancy pricing

-

Daily price: If the property does not have a single day with pricing that requires the LOS pricing model to be set in the channel

If you want to change the pricing model for a property in Airbnb, it can be done only by a repeated auto-detection. Here is how to do it:

-

Add the pricing you want in Rentals United (e.g. add LOS prices).

-

Update the listing content (see here how to do it).

-

The pricing model is detected during the content listing update and changed.

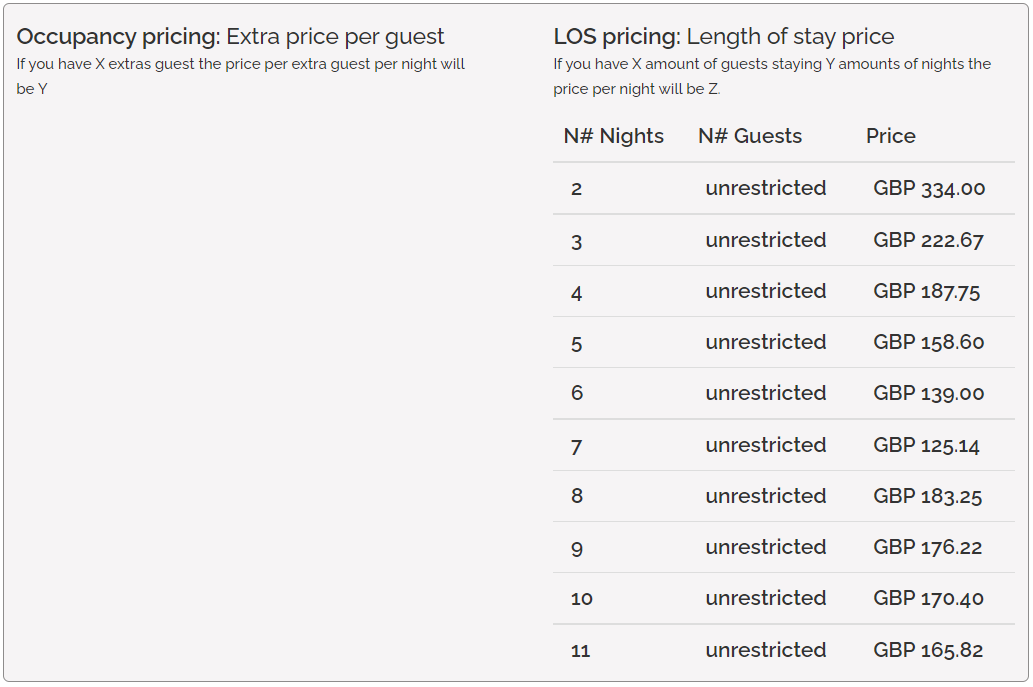

LOS pricing model

Airbnb supports LOS pricing. If you use LOS pricing model, it will be fully sent to Airbnb.

For Airbnb LOS we calculate prices for up to 30 nights long stays.

Example: The user has Daily price = 200 USD. Also, LOS pricing is set for LOS1 to LOS6 in the following way:

LOS1, LOS2: 170 USD

LOS3, LOS4: 180 USD

LOS5, LOS6: 190 USD

For LOS nights that are not specified (LOS7 to LOS30), we will use Daily price and multiply it by the number of nights.

LOS7: 200 USD x 7 = 1400 USD

LOS8: 200 USD x 8 = 1600 USD

...

LOS30: = 200 USD x 31 = 6 200 USD

Airbnb will calculate the prices for stays over 30 nights from the nearest specified price that does not exceed the length of the stay.

Example: The user has LOS pricing set for LOS1 to LOS30. If a 31-nights reservation or longer is inserted, then Airbnb takes the closest price (LOS30 in this case) and calculates the nightly value. Then, the nightly value is multiplied by the number of nights in the reservation (31 in this case).

LOS30 = 12 000 USD

12 000 USD / 30 = 400 USD

400 USD x 31 = 12 400 USD

LOS31 = 12 400 USD

|

|

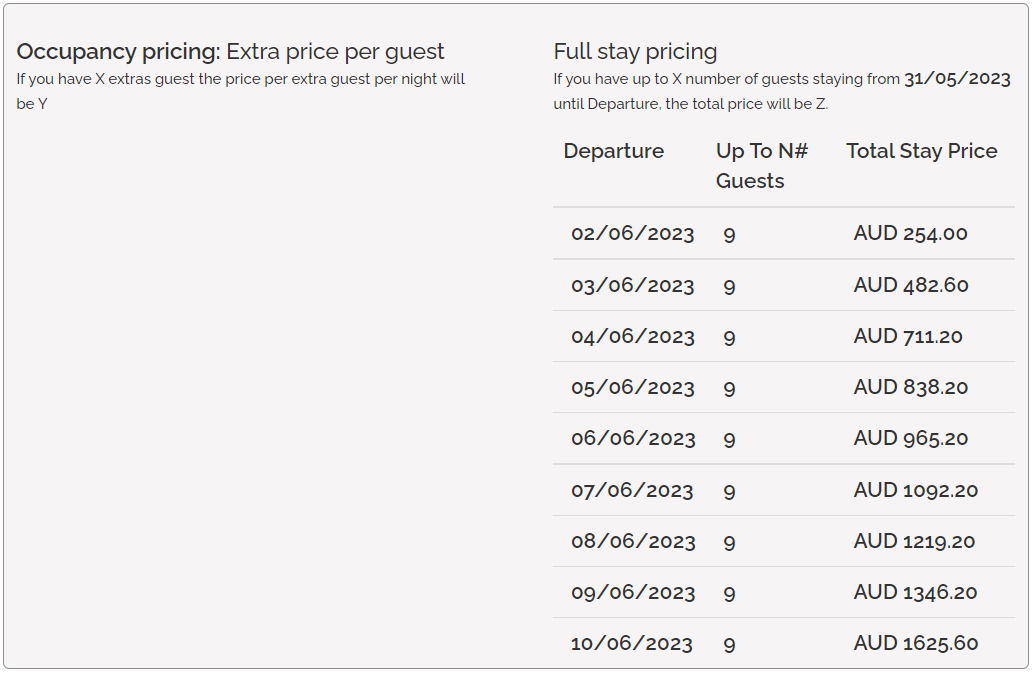

FSP pricing model

Airbnb supports FSP pricing. If you use FSP pricing model, it will be fully sent to Airbnb.

|

|

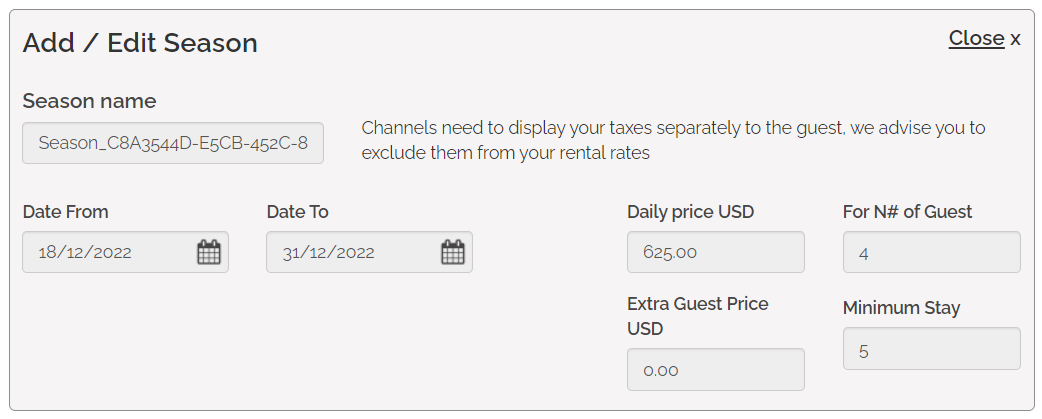

Daily price model

Daily price

Daily price is the standard way of setting prices. It indicates the base price per night for the Standard number of guests. It also constitutes the basis for the Daily price model. Note, however, that the Daily price value which is eventually available for the potential guest depends on the data introduced in the following fields:

-

Standard number of guests

-

Extra guest price or Occupancy pricing

|

|

Standard number of guests

Standard number of guests refers to the maximum number of guests included in the Daily price for whom the price does not change. If more guests than specified book a stay, the extra guests will be charged with the price set in the Extra guest price element.

|

|

Extra guest price

Extra guest price is the price for guests that are not included in the Standard number of guests. In other words, if the overall number of guests exceeds the Standard number of guests, Extra guest price is applied for each guest above the specified standard.

Airbnb does not expect Extra guest price to vary by seasons or by the number of guests. Hence, Rentals United calculates the average Extra guest price from all seasons with defined prices (starting from the day of reservation for the next 2 years maximum) and shares with Airbnb only one value.

Extra guest price is visible in the reservation price breakdown as a separate line item since 26-06-2025.

Example: Standard number of guests is 4, Maximum number of guests is 6. The difference between Standard number of guests and Maximum number of guests is 2.

-

For 8 months, the user has Extra guest price set to 0 EUR.

-

For the next 8 months, the user has Extra guest price set to 20 EUR (2 x 20 EUR = 40 EUR)

-

For the remaining 8 months, user has Occupancy pricing defined in the following way:

-

the 5th guest is charged 5 EUR;

-

the 6th guest is charged 15 EUR for 6th guest.

This results in 5 EUR + 15 EUR = 20 EUR.

-

For calculation simplicity, each month is assumed to be 30-days long and year to be 360-days long. Then, the following calculation is performed:

240 days x 0 EUR = 0 EUR

240 days x 40 EUR = 9,600 EUR

240 days x 20 EUR = 4,800 EUR

The above results are summed up and divided by the total number of days and the number of guests.

14,400 EUR : 720 days : 2 people = 10 EUR

In this case, the average Extra guest price is 10 EUR.

|

|

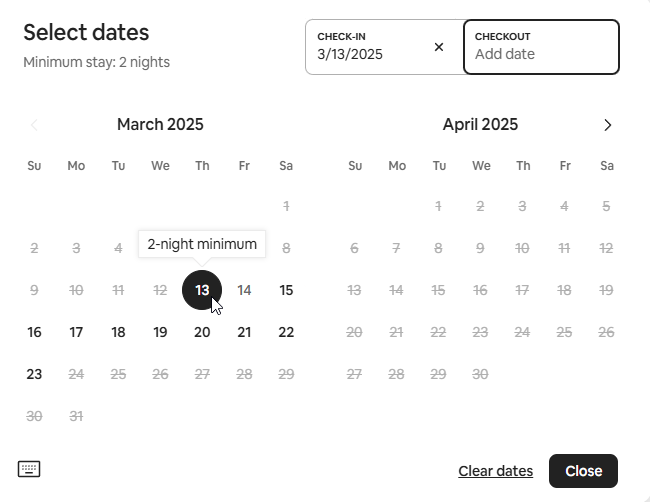

Minimum stay / Maximum stay

Minimum stay indicates the minimum number of days a reservation can be made for. Guests will be not be able to book your property if they want to book stays shorter than minim stay. This value is mandatory to provide.Maximum stay is an additional setting (optional), which ensures that your guests will not be offered stays longer than a particular number of nights.

There are two types of stay restriction in Rentals United. The default stay restriction type is stay-through. You can choose which model you want to work on and your selection will apply to both minimum and maximum stay restrictions at the same time. If you want to change the stay restriction type, see here.

-

Stay-through - the booking must meet the minimum / maximum stay requirements on each day of the booking

-

Arrival-based - the booking must meet the minimum / maximum stay requirements on the arrival day only

Your listing in Airbnb will be available according to the selected minimum and maximum stay type, with the following restrictions:

-

In daily pricing: If you are using daily pricing, Airbnb will always treat your Minimum stay / Maximum stay settings as Arrival-based, even if your restriction type is set to Stay-through. If you want to use the Stay-through restriction type, you need to switch to the LOS pricing. Stay-through restriction type is possible only for properties in LOS pricing.

-

In LOS pricing: Airbnb will correctly display the maximum stay according to your setting.

-

In FSP pricing: You should create the FSP prices only for the periods when you accept stays and incorporate your stay restrictions in the FSP prices.

Example: Daily pricing

You have the stay-through / arrival-based stay restrictions in :

-

11-05-2021 to 16-05-2021: MS is 5; MX is 7

-

17-05-2021 to 20-05-2021: MS is 7; MX is 7

Some of the stays:

-

5-night-long stay (11 - 16 May) is possible (as the minimum stay on 11th May is 7)

-

5-night-long stay (13 - 18 May) is possible (as the minimum stay on 13th May is 7)

-

6-night-long stay (11 - 17 May) is possible (as the minimum stay on 11th May is 7)

-

7-night-long stay (11 - 18 May) is possible (as the minimum stay on 11th May is 7)

-

8-night-long stay (11- 19 May) is not possible (as the maximum stay on 11th May is 7)

Example: LOS pricing

You have the stay-through stay restrictions in :

-

11-05-2021 to 16-05-2021: MS is 5; MX is 7

-

17-05-2021 to 20-05-2021: MS is 7; MX is 7

Some of the stays:

-

5-night-long stay (11 - 16 May) is possible

-

5-night-long stay (13 - 18 May) is not possible (as the minimum stay on 18th May is 7)

-

6-night-long stay (11 - 17 May) is possible

-

7-night-long stay (11 - 18 May) is possible

-

8-night-long stay (11- 19 May) is possible (as the maximum stay is currently not supported in LOS)

You have the arrival-based stay restrictions:

-

11-05-2021 to 16-05-2021: MS is 5; MX is 7

-

17-05-2021 to 20-05-2021: MS is 7; MX is 7

Some of the stays:

-

5-night-long stay (11 - 16 May) is possible

-

5-night-long stay (13 - 18 May) is possible

-

6-night-long stay (11 - 17 May) is possible

-

7-night-long stay (11 - 18 May) is possible

-

8-night-long stay (11- 19 May) is possible (as the maximum stay is currently not supported)

|

|

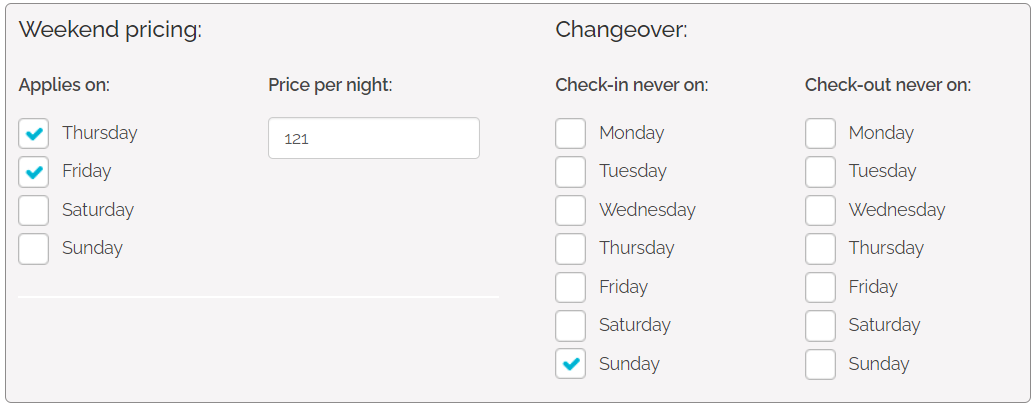

Weekend pricing

Weekend pricing refers to a specific type of pricing rules that are applied on selected weekend days only. If the weekend-specific pricing is set and the reservation matches specified criteria, then the Weekend pricing will be applied instead of the Daily price.

|

|

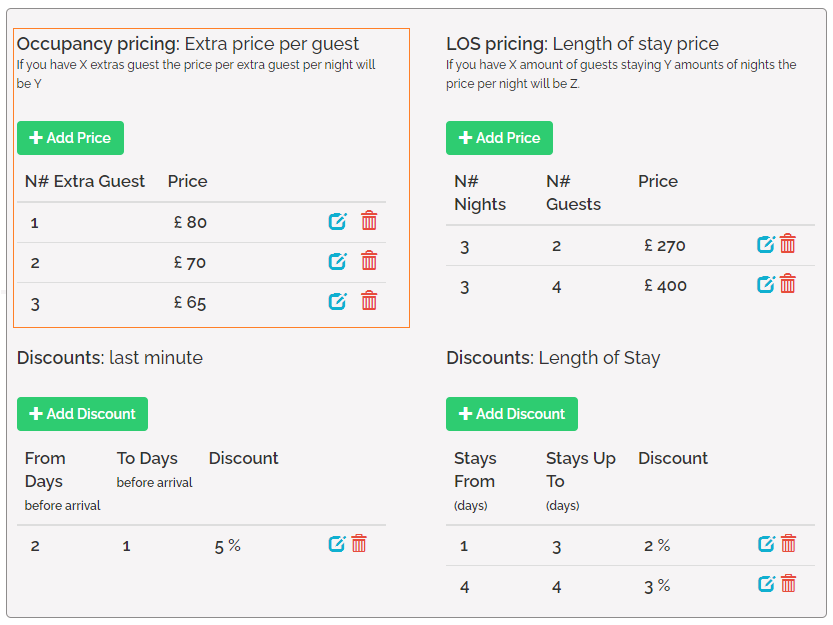

Occupancy pricing

In Occupancy pricing, it is possible to specify pricing plans for different numbers of guests. The difference between Extra guest price and Occupancy pricing lies in fact that with Extra guest price the same price is applied for each extra guest. On the other hand, in Occupancy pricing it is perfectly possible to specify different prices for different numbers of guests. Note that Occupancy pricing takes precedence over Extra guest price.

Airbnb does not expect Extra guest price to vary by seasons or by the number of guests. Hence, Rentals United calculates the average Extra guest price from all seasons and shares with Airbnb only one value. For more information, please see Extra guest price.

|

|

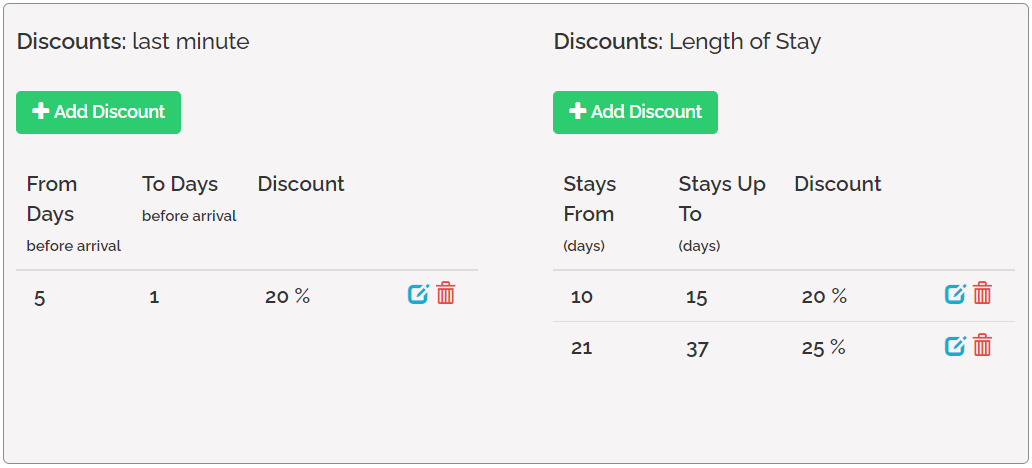

Discounts

Discounts are applied in order to deduct certain amount from the price, provided the specified requirements are met by the reservation. Currently, there are two types of discounts:

LOS discount may be applied when criteria specified for the length of stay are met. For example, LOS discount may apply only for 3-days stays. Last-minute discount on the other hand is applied if the reservation is made within the specified time before the check-in day.

Read more about Airbnb discounts here.

LOS discount

Rentals United sends your LOS discount to Airbnb only if you operate on the Daily price model. In this case, Airbnb will present this information to guests on their website. However, if you use LOS pricing model, LOS discount will not be shared with the channel.

Airbnb does not allow discounts to be lower for longer stays. For example, your 7-days stays should have lower discounts than a 15-days stay. Hence, Rentals United implemented a mechanism that will enforce this rule. This may result in prices in Airbnb being slightly different than in Rentals United.

Example: Your long-stay discounts are automatically expanded

7 - 14 days = 5%

15 - 21 days = 7%

In this case, for stays longer than 21 days, Airbnb will automatically apply the discount of 7%.

Example: Your short-stay discounts are decreased

7 - 14 days = 5%

15 - 21 days = 3%

In this case, discounts for shorter stays are decreased to 3%. Also, stays longer than 21 days will have a 3% discount applied.

|

|

Last-minute discount

Airbnb splits the discount into two types of promotions on their website:

-

discounts up to 28 days are visible in Airbnb as regular price (no strike-through)

-

discounts from 29 days to 180 days are visible in Airbnb as an early-bird discount (regular price is greyed out and the discounted price is active)

|

|

New Listing Promotion

New Listing Promotion is a new type of a promotion exclusive for Airbnb. New Listing Promotion works by applying the 20% discount for the first 3 bookings. You can apply this promotion to any listing that has not yet received 3 bookings (new and existing listings). After the listing is booked 3 times, this promotion expires automatically.

Do you want to enable New Listing Promotion? See here.

Complimentary topics

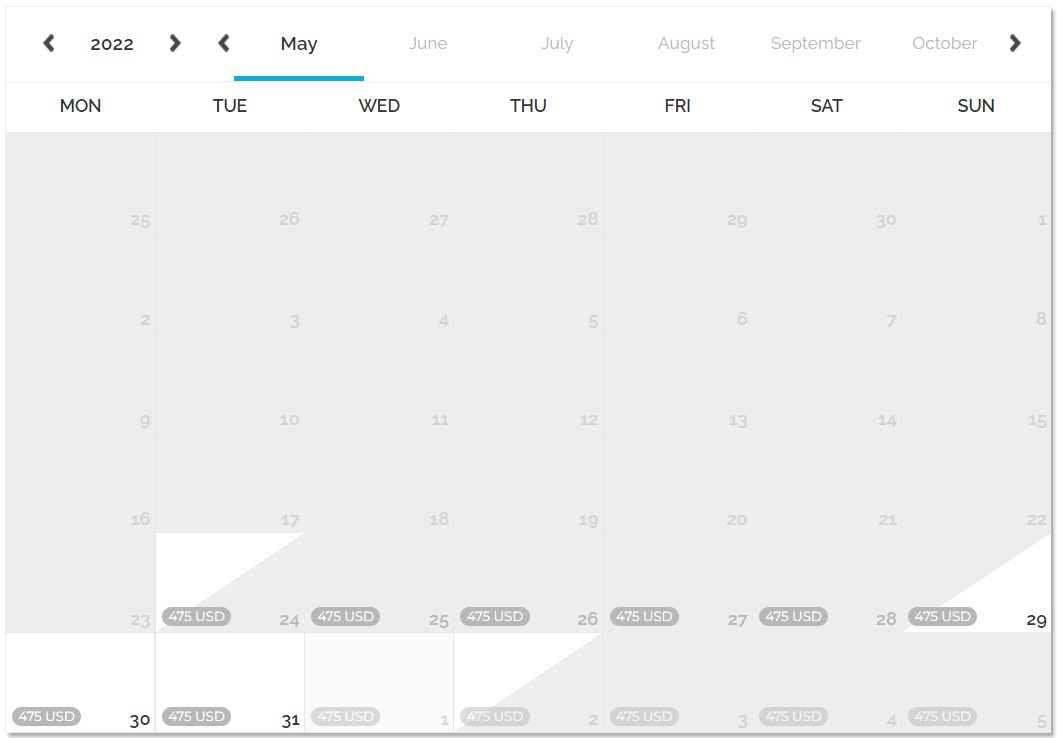

Calendar

Calendar stands for the property's availability to rent. You can check here the availability of your property in the selected time frames. Once a reservation is inserted in Rentals United, the availability in the calendar gets blocked for this period. The calendar is updated automatically every time the availability of the property changes or at predefined times to remain up-to-date.

|

|

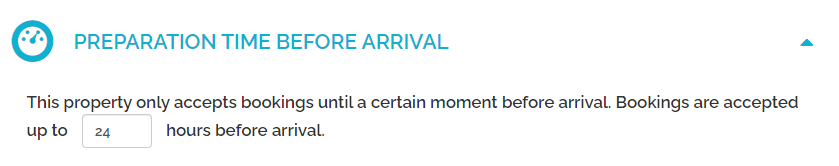

Preparation Time Before Arrival

PTBA stands for Preparation Time Before Arrival. It is a general keyword to describe the minimum time a booking has to be made in advance in order to be accepted by the PM. The dates restricted by PTBA are normally set as not available already in the calendar. Hence, the PTBA data is already applied in availability and sent to the channel within the ARI data.

The PTBA in Rentals United blocks the availability x hours from 23:59 of the day of arrival on the property's local timezone. For example if the PTBA is set to 6 hours, bookings will be accepted until 18:00 of the day of arrival, after 18:00 the calendar will be closed. If the PTBA is set to 24 hours, bookings will be accepted until 23:59 before the day of arrival, after that the calendar will be closed.

Supported values

Airbnb supports the following PTBA values: 0 - 24, 48, 72 and 168 hours.

-

If you set the PTBA to any of the above values, Airbnb will display the exact value you put in Rentals United.

-

If you set the PTBA to values not supported by Airbnb e.g. 30, we will pass to Airbnb the closest smaller value supported e.g. 24.

If you use the PTBA settings, the availability in Airbnb will be blocked to ensure the property is not available to book. It is done in a regular availability update.

PTBA = 6 hours

Bookings cannot be made less than 6 hours before the 23:59 PM of the arrival day, that is 6 PM on the day of arrival. It means the same-day bookings are allowed until 6 PM.

PTBA = 30 hours

If you set PTBA in Rentals United to 30 hours, we will set it in Airbnb to the closest smaller value - 24 hours. Bookings cannot be made less than 24 hours before the 23:59 PM of the day of arrival. It means the same-day bookings are not allowed.

Booking requests

By default, booking requests cannot be made within the PTBA-blocked periods. If you wish to receive requests within the PTBA-blocked period, you can enabled additional settings in Channel Settings - see here. Such requests can be confirmed or rejected as in the Request-to-book flow (see here).

|

|

Updates to PTBA

The PTBA is synchronised for properties on both modes: Sync Everything and Limited Sync. Whenever the PTBA settings are updated, an immediate partial content update is performed to Airbnb. The PTBA updates are also sent to Airbnb when updating your listings (here) as well as in the automatic update if you have it turned on (here).

Bookings made too far in advance

If you do not want your guests to book your property too far in the future, you can limit the property's availability. By default, Airbnb receives information that the property can be booked for stays maximum 365 days in advance. If you wish to change the property's availability window, contact

|

|

Changeover restrictions

Changeover restrictions specify whether check-in or check-out is allowed for a given day. This is a great option if you need the guests checking in and out to fit your schedule and it will help you avoid unexpected guests. If some days are restricted from changeovers, then your guests will simply not be able to select such a stay if the start or end day falls on a changeover-restricted day.

|

|

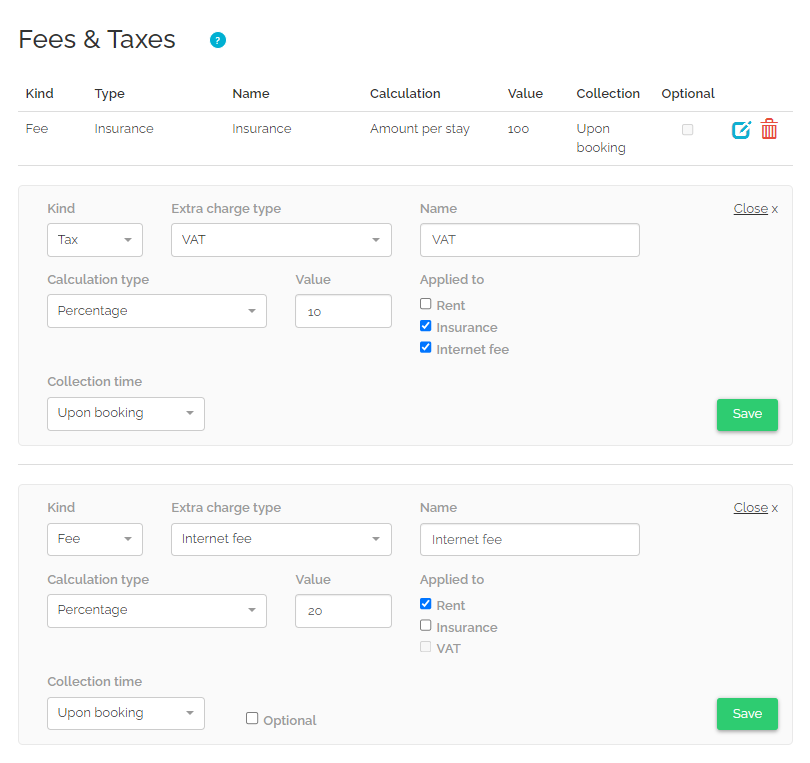

Fee and Tax

Fee refers to mandatory or optional charges paid in exchange for particular services. These include:Charges for additional services, for example Internet access or shuttle.

Fees defined by local governments that do not fall into the tax category, for example environmental fees.

Tax refers to mandatory charges legally levied on particular types of goods, services and transactions, paid as a contribution to the state’s revenue, for example VAT or city tax.

If you connected to Airbnb after 2023-08-10, you have Airbnb fees and taxes v3 enabled by default.

If you connected to Airbnb before, you are using one of our Legacy solutions. Note that legacy solutions are no longer developed and we recommend upgrading to Airbnb fees and taxes v3 , which is a complete solution for all your fees and taxes and preserves all Airbnb functionalities.

Fees and taxes v3 - how it works

Before you start reading this article, please get familiar with these Airbnb articles where it is explained how fees and taxes are handled in Airbnb:

How does occupancy tax collection and remittance by Airbnb work?

In what areas is occupancy tax collection and remittance by Airbnb available?

| Rentals United | Airbnb ID (1) | Accepted collection time (2) | Accepted calculation type (3) |

|---|---|---|---|

| Air-conditioning fee | PASS_THROUGH_AIR_CONDITIONING_FEE | Upon arrival | Amount per stay |

| Airport shuttle fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Bed linen fee | PASS_THROUGH_LINEN_FEE | Upon booking, Upon arrival | Amount per stay, Amount per person & stay |

| Book Direct service fee | PASS_THROUGH_MANAGEMENT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Booking fee | PASS_THROUGH_MANAGEMENT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Children extra fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Cleaning fee (6) | PASS_THROUGH_CLEANING_FEE | Upon booking, Upon arrival | Amount per stay |

| Short term cleaning fee (6) | PASS_THROUGH_SHORT_TERM_CLEANING_FEE | Upon booking, Upon arrival | Amount per stay |

| Club card fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Conservation fee | PASS_THROUGH_COMMUNITY_FEE |

Upon booking

__________________

Upon arrival

| Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage _________________ Amount per stay, Amount per person & stay, Percentage |

| Credit card fee | PASS_THROUGH_MANAGEMENT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Destination fee | PASS_THROUGH_COMMUNITY_FEE |

Upon booking

__________________

Upon arrival

| Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage _________________ Amount per stay, Amount per person & stay, Percentage |

| Electricity fee | PASS_THROUGH_ELECTRICITY_FEE | Upon arrival | Amount per stay |

| Environment fee | PASS_THROUGH_COMMUNITY_FEE |

Upon booking

__________________

Upon arrival

| Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage _________________ Amount per stay, Amount per person & stay, Percentage |

| Extra bed fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Gas fee | PASS_THROUGH_UTILITY_FEE | Upon arrival | Amount per stay |

| Heating fee | PASS_THROUGH_HEATING_FEE | Upon arrival | Amount per stay |

| Housekeeping fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Insurance | PASS_THROUGH_MANAGEMENT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Internet fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Kitchen linen fee | PASS_THROUGH_LINEN_FEE | Upon booking, Upon arrival | Amount per stay, Amount per person & stay |

| Linen package fee | PASS_THROUGH_LINEN_FEE | Upon booking, Upon arrival | Amount per stay, Amount per person & stay |

| Oil fee | PASS_THROUGH_UTILITY_FEE | Upon arrival | Amount per stay |

| Parking fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Pet fee (4) | PASS_THROUGH_PET_FEE | Upon booking | Amount per stay, Amount per night |

| Resort fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Sea plane fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

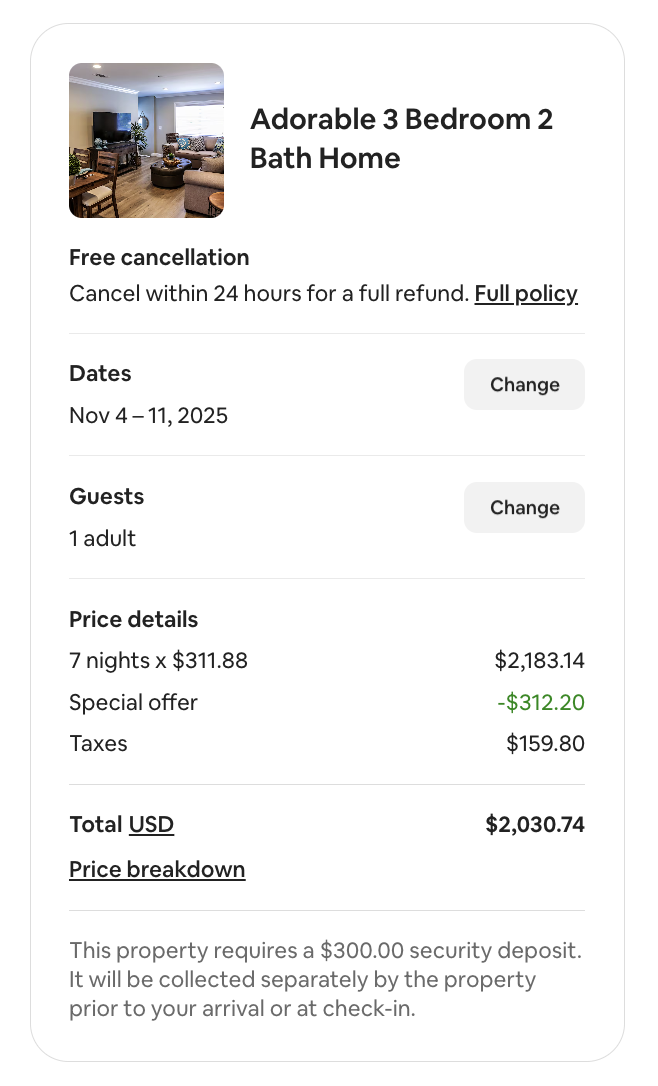

| Security deposit (5) | PASS_THROUGH_SECURITY_DEPOSIT | Upon arrival | Amount per stay |

| Service fee | PASS_THROUGH_MANAGEMENT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Shuttle boat fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Ski pass | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Towels fee | PASS_THROUGH_LINEN_FEE | Upon booking, Upon arrival | Amount per stay, Amount per person & stay |

| Transfer fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Unknown fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Visa support fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Water park fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Water usage fee | PASS_THROUGH_WATER_FEE | Upon arrival | Amount per stay |

| Wood fee | PASS_THROUGH_UTILITY_FEE | Upon arrival | Amount per stay |

| Wristband fee | PASS_THROUGH_RESORT_FEE | Upon booking, Upon arrival | Amount per stay, Amount per night, Amount per person & night, Amount per person & stay, Percentage |

| Local tax | PASS_THROUGH_LODGING_TAX | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

| VAT | PASS_THROUGH_VAT_GST | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

| Tourist tax | PASS_THROUGH_TOURIST_TAX | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

| Goods and services tax | PASS_THROUGH_VAT_GST | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

| City tax | PASS_THROUGH_SALES_TAX | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

Tourism fee

(Note: Although Tourism fee is a fee in Rentals United, the PASS_THROUGH_TOURISM_ASSESSMENT_FEE is a tax in Airbnb. See here.) | PASS_THROUGH_TOURISM_ASSESSMENT_FEE | Regardless of your settings, always sent as upon booking | Percentage, Amount per night, Amount per person & night, Amount per person & stay |

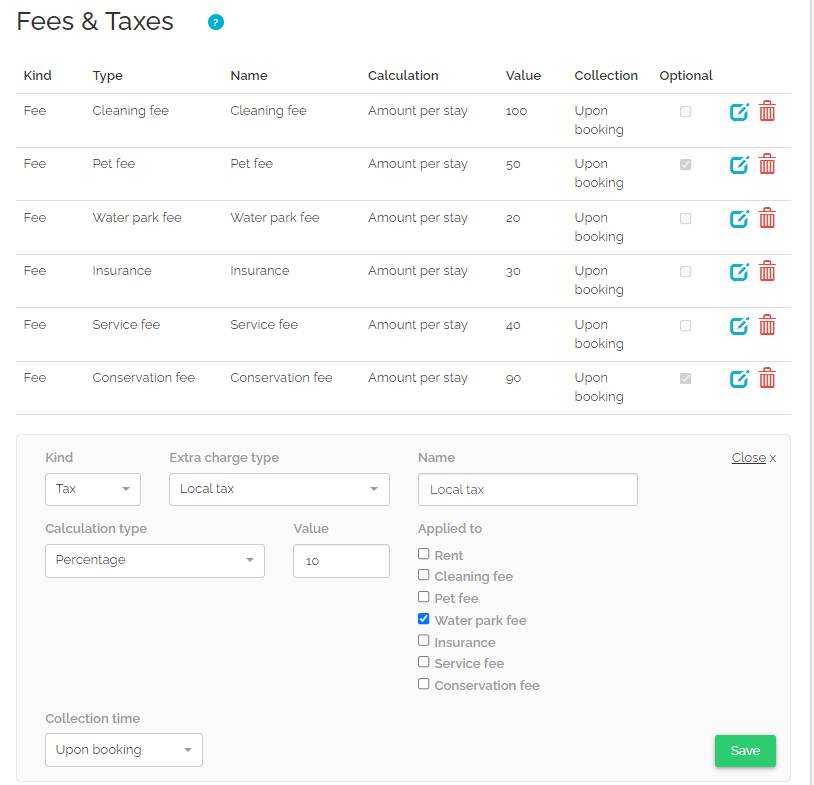

General rules for fees in v3

(1) There are a few rules you should be aware of in case you have two or more fees that are displayed in Airbnb under the same name and:

if you have different calculation types, e.g. percentage and amount per stay, then we will send the one set as amount per stay

if you have the same calculation types, e.g. all are percentage, then we will sum them up

if you have the same calculation types, but the collection time is different, e.g. one of them is charged upon arrival and the other upon booking, then we will set it as upon booking

v2 & v3: if you have different calculation types, e.g. amount per stay and amount per person & stay, then we will sum them up

(2) Collection time (upon booking / upon arrival):

if both values are accepted by Airbnb, fees will be charged by Airbnb according to the setting

if Airbnb accepts only one value and you selected the other one, we will send the required setting anyway

(3) Calculation type

percentage fees are calculated only from the base rent price

only the following calculation types are supported (charges with other calculation types may not be sent correctly to Airbnb or can be skipped):

Version Rentals United calculation type Airbnb v1 & v2 & v3 Amount per stay Amount per stay v1 & v2 & v3 Percentage Percentage v1 & v2 & v3 Cumulative percentage Percentage v1 & v2 & v3 Independent percentage per day Percentage v2 & v3 Amount per person & stay Amount per person & stay v2 & v3: if Airbnb does not accept per person & stay calculation type, but you select it anyway, we will take this fee and multiply it by the maximum number of guests - see here

Tip: In case many guests can sleep at the property (e.g. 14), but the property is rented in fact by just a few guests (e.g. 4), then this workaround may result in a difference in price, which cannot be accepted by the host. The solution is to change the calculation type to whatever is more accurate. Also, note that Airbnb accepts some charges to be per person & stay (e.g. bed linen), so you can also try to find a better mapping.

(4) Pet fee

v1: pet fee is not sent to Airbnb

v2 & v3: even when it is set as optional, it is always shared with Airbnb. Airbnb applies it only if there is any pet in the reservation. If you define the pet fee, Airbnb also requires a Pets are welcome amenity to be added to your property. If your property does not have this amenity, we will automatically add it.

v2 & v3: we can set the Pet fee in Airbnb to apply per pet or per group of pets. If you want your fee to apply per pet, set the pet fee to one of the following calculation types:

Amount per stay

Amount per night

Amount per person & stay

Amount per person & night

If the selected calculation type for pet fee is different, the pet fee amount will apply for a group of pets in the Airbnb booking.

(5) Security deposit is sent to Airbnb regardless on the fee & tax version you are on

(6) Cleaning fees are always sent to Airbnb regardless on the fee & tax version you are on

Short term cleaning fee applies to reservations with a length of only 1 or 2 nights; it must be used together with the cleaning fee, and its amount must be lower than the cleaning fee

Short term cleaning fee is marked as optional in Rentals United, however it will not show up as optional in Airbnb. In fact, if the conditions are met, it will be applied with priority over the regular cleaning fee.

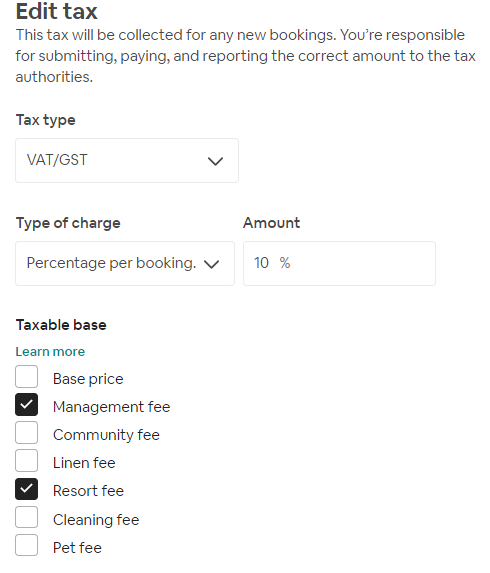

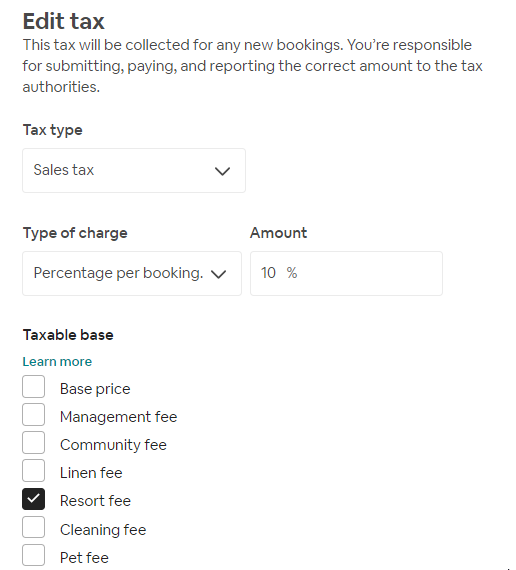

(7) Taxes

v1 & v2: taxes you have in Rentals United are passed to Airbnb as fees - see legacy solutions here

v3: we send occupancy taxes to Airbnb - see here

(8) Optional fees

v1: Airbnb does not accept optional fees in any way.

v2 & v3: Airbnb does not accept optional fees in any way. The only exception is pet fee.

General rules for taxes in v3

In case a tax is applied to Fee A and there is also Fee B and both types are mapped to the same Airbnb fee type, then the tax will be applied to both in Airbnb.

If we have multiple taxes with different calculation types in Rentals United being mapped to one Airbnb tax type, then we will disregard some of these taxes according to the priorities:

Percentage

Amount per person & stay

Amount per night

Amount per person per night

It is not possible to apply taxes onto other taxes and some fees. This is because Airbnb allows only base price and selected fees to be taxable. In general, these allowed fees are the standard fees: resort, community, management, linen, cleaning fees.

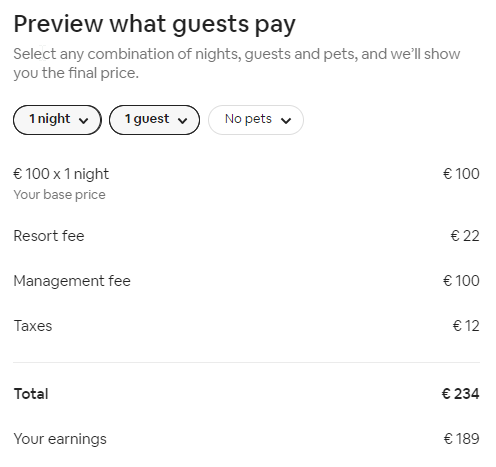

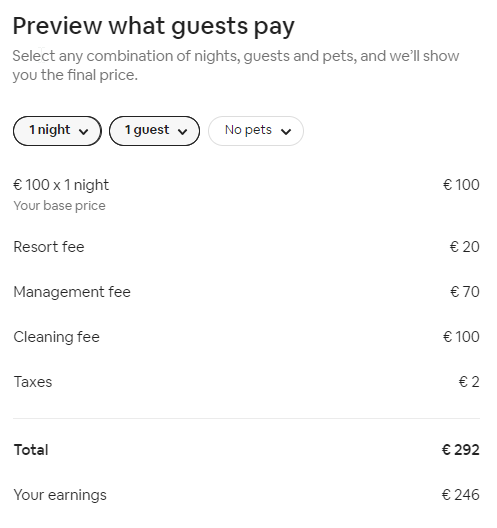

Sending fees and taxes to Airbnb - examples

Rentals United Airbnb What will guest see | Rent is 100 EUR. VAT (10%) is applied onto:

|

| Rentals United Airbnb

What will guest see

| Rent is 100 EUR.

|

Upgrading to fees and taxes v3

In fees and taxes v3, your fees and taxes will be sent according to this table. Here are the steps to upgrade.

Provide additional licence information in Step 1: Basic info. See here for more information how to fill it in.

Go to Sending fees and taxes and read how to change the option you are using. Switch to fees and taxes v3.

Do not forget to perform a manual listing content update or wait until the automated listing content update is finished. You will not see the tax information in Airbnb unless listing content update is complete.

Note: Once you are on fees and taxes v3, it is not possible to downgrade to other options.

Limitations and troubleshooting v3

1. You enabled fees and taxes v3 and taxes were synced to Airbnb successfully

Occupancy taxes were successfully sent to Airbnb. You may want to see this Airbnb article to see if Airbnb will pay them to the government on your behalf or you need to pay them yourself. If you have doubts how it works, please contact Airbnb.

2. Taxes did not appear in Airbnb and there is no error in Rentals United

First of all, make sure that you have Airbnb fees and taxes v3 enabled in Rentals United and you have correct setting - see here. If the option is enabled and the setting is correct, and taxes still do not appear in Airbnb, it means this location is not eligible for occupancy taxes and we cannot send the taxes to Airbnb. You may double check by reading this Airbnb article.

If they do, nothing is required from your side. Airbnb will collect and remit taxes on your behalf. They will subtract the tax amount from the base rent price, so you may consider increasing the rent with the tax amount to be paid.

If they do not, you need to pay the tax to the government yourself. Again, you may want to increase your base price to cover for the tax amount to be paid.

3. You enabled fees and taxes v3 and received the notification

It means Airbnb has their own tax rules in this location and we will not send any occupancy taxes. Airbnb remits some of the taxes on your behalf, but you may be required by law to pay additional taxes. In this case, you need to add them directly in the Airbnb dashboard. Airbnb will collect these additional taxes from the guest and remit them to you, but you need to remit them to the government on your own.

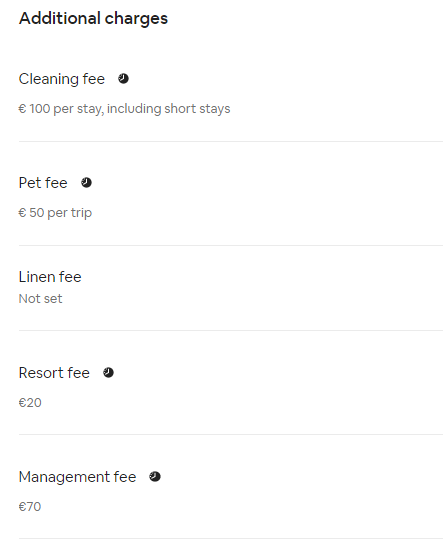

Fees and taxes visibility to guests

Fees

All offline fees are presented to potential guests as part of the booking process. They appear in the payments page under Additional property charges, before finalising the reservation. To enhance the guest experience, standard fees may not always be displayed as separate line items during the booking process. Instead, these fees are incorporated into the following overall charges:

Cleaning, Short-term cleaning & Linen fees: displayed as “Cleaning fee”

Community, Management, Resort & Pet fees: displayed as part of the nightly price - these fees will not show as separate items

Taxes

The total amount of occupancy taxes will be summarised and presented to the guest as a single line item labelled "Occupancy Taxes". Guests have the option to view the specific types of occupancy taxes by hovering over this line item, which reveals a tooltip with the details.

Importing properties with fees and taxes

When importing a property from Airbnb, we will try to mimic Rentals United to Airbnb mappings. However, it is not always possible as multiple charges in Rentals United are sometimes mapped to one charge type in Airbnb. Therefore, we need to choose the single charge that will be used when importing a property from Airbnb to Rentals United. See the table below.

Airbnb | Rentals United |

|---|---|

| PASS_THROUGH_LODGING_TAX | Local tax |

PASS_THROUGH_VAT_GST | Goods and services tax |

PASS_THROUGH_TOURIST_TAX | Tourist tax |

PASS_THROUGH_SALES_TAX | City tax |

| PASS_THROUGH_CLEANING_FEE | Cleaning fee |

| PASS_THROUGH_SHORT_TERM_CLEANING_FEE | Airbnb Short term cleaning fee |

PASS_THROUGH_MANAGEMENT_FEE | Service fee |

PASS_THROUGH_RESORT_FEE | Resort fee |

PASS_THROUGH_LINEN_FEE | Bed linen fee |

PASS_THROUGH_COMMUNITY_FEE | Destination fee |

PASS_THROUGH_UTILITY_FEE | Gas fee |

Legacy solutions

Legacy solutions are no longer developed. We recommend upgrading to Airbnb fees and taxes v3. If you are still using our legacy solutions, you can read more about them here.

Down payment (N/A)

Security deposit

Security deposit is a mandatory or optional refundable charge the guest needs to pay to cover for potential property damages.

By default, Airbnb does not collect the security deposit from your guest. This should be handled at the guests' check-in and remitted at check-out by your property manager.

|

Currency

Currency in Rentals United is a fixed value, by default established on the basis of the property location. The currency of any property can be checked in Rentals United, go to Step 5: Price and availability after selecting All properties tab.

Rentals United sends prices to Airbnb in the same currency as it is set in Rentals United. Bookings are received in the same currency as the one Rentals United sends. In case the currency of your property in Rentals United does not match the one in Airbnb, Rentals United will convert the pricing.

|